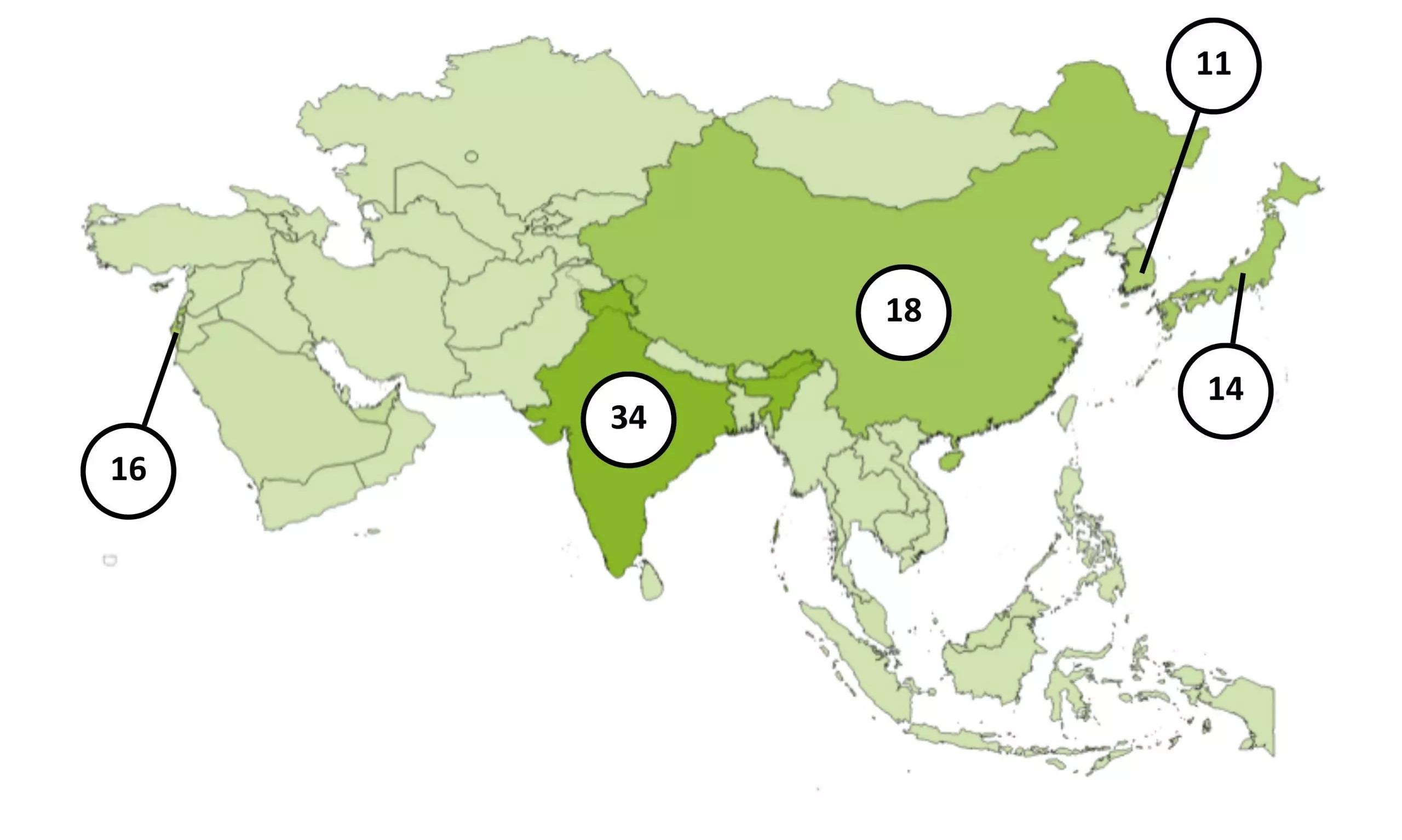

Global Expansion Strategies for FinTechs in Emerging Markets: A Playbook for Leaders

2nd August 2025

How AI is Transforming the Credit Scoring System

How AI is Transforming the Credit Scoring System

How Open Banking is Shaping Financial Services Globally

How Open Banking is Shaping Financial Services Globally

Top Fintech Innovations Shaping 2025: The Future of Finance

Top Fintech Innovations Shaping 2025: The Future of Finance

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

QR Codes and the Cashless Leap: Transforming India's Financial DNA

QR Codes and the Cashless Leap: Transforming India's Financial DNA

Biometric Payments: The Next Big Trend in Secure Transactions

Biometric Payments: The Next Big Trend in Secure Transactions

The Role of Cryptocurrencies in Cross-Border Payments

The Role of Cryptocurrencies in Cross-Border Payments

.jpg) The Future of Payments: Trends Reshaping Transactions in 2025

The Future of Payments: Trends Reshaping Transactions in 2025

The Impact of 5G on Fintech Services

The Impact of 5G on Fintech Services

The Evolution of Fintech Regulation: What’s Next?

The Evolution of Fintech Regulation: What’s Next?

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

The Rise of Contactless Payments: Benefits and Security Concerns

The Rise of Contactless Payments: Benefits and Security Concerns

24 May 2025

2 min read

272

The Reserve Bank of India (RBI) has set up a newly constituted Payments Regulatory Board (PRB) to oversee the country’s fast-growing digital payments landscape, formally replacing the earlier Board for Regulation and Supervision of Payment and Settlement Systems (BPSS). The new six-member board marks a notable shift in regulatory dynamics by granting the central government a formal role in payment system oversight for the first time.

Chaired by the RBI Governor, the PRB will also include the Deputy Governor in charge of payment systems, one RBI-nominated official, and three members nominated by the central government. All six members hold equal voting rights, with the Chairperson casting the deciding vote in case of a tie.

The RBI said the board will meet at least twice a year, and may invite subject-matter experts in payments, law, and information technology to its meetings. The Principal Legal Adviser to the RBI will attend as a permanent invitee.

The decision aligns with a recent government notification under the Payment and Settlement Systems Act, 2007. It also reflects an evolving governance model where the regulatory apparatus for digital payments becomes more inclusive of policy-level interests.

While the RBI had historically voiced concern over external oversight of payment systems, the current structure maintains its leadership role while opening doors to collaborative governance. Analysts view the new PRB as a move to balance financial innovation, regulatory security, and national policy objectives.

India’s digital payments ecosystem has seen exponential growth in recent years, prompting a need for more agile and responsive regulatory mechanisms. The PRB is expected to play a key role in ensuring that growth is sustained without compromising consumer protection or systemic stability.

Reference: ETBFSI

Read Next

News

News

News

News

Article

Article

News

News

News

News

Live Polls

Live Discussion

Topic Suggestion

Whom Do You Wish To Hear

Sector Updates

Leave your opinion / comment here