Global Expansion Strategies for FinTechs in Emerging Markets: A Playbook for Leaders

2nd August 2025

QR Codes and the Cashless Leap: Transforming India's Financial DNA

QR Codes and the Cashless Leap: Transforming India's Financial DNA

How AI is Transforming the Credit Scoring System

How AI is Transforming the Credit Scoring System

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Biometric Payments: The Next Big Trend in Secure Transactions

Biometric Payments: The Next Big Trend in Secure Transactions

The Role of Cryptocurrencies in Cross-Border Payments

The Role of Cryptocurrencies in Cross-Border Payments

The Evolution of Fintech Regulation: What’s Next?

The Evolution of Fintech Regulation: What’s Next?

The Impact of 5G on Fintech Services

The Impact of 5G on Fintech Services

Top Fintech Innovations Shaping 2025: The Future of Finance

Top Fintech Innovations Shaping 2025: The Future of Finance

.jpg) The Future of Payments: Trends Reshaping Transactions in 2025

The Future of Payments: Trends Reshaping Transactions in 2025

The Rise of Contactless Payments: Benefits and Security Concerns

The Rise of Contactless Payments: Benefits and Security Concerns

How Open Banking is Shaping Financial Services Globally

How Open Banking is Shaping Financial Services Globally

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

Explore more

Explore more

Explore more

Explore more

Explore more

Explore more

Explore more

.jpg)

Explore more

Explore more

Explore more

Blog

Blog

News

News

News

News

News

News

News

News

Blog

News

News

Blog

News

Blog

Live Discussion

Top Stories

Increase your brand visibility and thought leadership in Industry

Host events with UBS Expertise and engage your target audience

Showcase your product to industry influencers and CXOs

Live Polls

Topic Suggestion

Whom Do You Wish To Hear

Sector Updates

You May Have Missed

As global FinTech adoption matures in developed markets, forward-looking companies are increasing...

Not too long ago, Buy Now, Pay Later (BNPL) was a quirky option tucked into checkout pages—a conv...

Major changes to the Unified Payments Interface (UPI) ecosystem come into effect starting today, ...

Zaggle Prepaid Ocean Services Limited, a leading corporate spend management firm based in Hyderab...

Future Generali India Insurance Company (FGII) has unveiled a bold growth strategy, aiming to dou...

Punjab National Bank (PNB), India’s third‑largest public sector lender, has reiterated its confid...

HSBC India delivered a strong performance in the first half of 2025, reporting a profit before ta...

The Government of India has notified key amendments under the Banking Laws (Amendment) Act, 2025,...

The Reserve Bank of India (RBI) has issued a strong caution to banks and non-banking financial co...

India’s crypto regulation debate has reignited following the United States' landmark legislation ...

Indian fintech startup Xflow has secured in-principle approval from the Reserve Bank of India to ...

SoftBank-backed InMobi, one of India’s earliest unicorns, is preparing to raise up to $1 billion ...

Reserve Bank of India Governor Sanjay Malhotra has flagged urgent concerns about the long‑term fi...

Bank of Baroda reported a 2% year-on-year increase in net profit for the quarter ended June 2025,...

SBI Cards and Payment Services reported a 6.5% year-on-year decline in net profit to ₹556 crore f...

The Enforcement Directorate (ED) has taken significant action against former UCO Bank Chairman an...

In a bid to enhance recovery of overseas dues, several Indian banks have formally sought approval...

In a major move that signals Tesla’s deeper entry into the Indian electric vehicle market, Kotak ...

In a bid to strengthen India’s thriving startup ecosystem, the Government of India has urged publ...

In a significant boost to cross-border payments, the digital payment systems of India and Singapo...

India’s fintech ecosystem raised $889 million in equity funding in the first half of 2025, markin...

Mumbai, July 9, 2025 — Indian equity markets opened on a subdued note Wednesday, dragged by weak ...

Indian equity benchmarks are poised for a consolidative session on Tuesday, as global cues remain...

In a significant development for India’s microfinance sector, the Microfinance Institutions Netwo...

Pune-based digital lending platform Fibe has promoted Vimal Saboo to the position of Chief Execut...

The Supreme Court on July 4, 2025, refused to quash the First Information Report (FIR) filed agai...

IndusInd Bank has inaugurated its 12th all‑women branch, this time in Chennai at the Saveetha Den...

In a strategic move to boost home loan demand, Bank of Baroda has reduced its floating-rate home ...

In a move aimed at enhancing borrower rights and improving transparency in the lending ecosystem,...

India's fintech sector witnessed a significant contraction in funding during the first half of 20...

On March 13, 2025, the Reserve Bank of India (RBI) granted Flipkart Finance Private Limited a Non...

Pine Labs, a leading fintech firm specialising in merchant payments, has formally filed its Draft...

Aditya Birla Capital Digital's (ABCD) mobile application was subjected to a significant cyber bre...

PhonePe and HDFC Bank have jointly launched a co-branded digital-first credit card aimed at accel...

The Reserve Bank of India (RBI) has announced new, stricter guidelines for the Aadhaar-Enabled Pa...

.jpg)

Stablecoins—a class of cryptocurrencies pegged to traditional assets like the U.S. dollar&m...

Mumbai-based fintech startup Saswat Finance has secured $2.6 million (₹22.3 crore) in a pre-Serie...

The catastrophic crash of Air India Flight AI‑171, a Boeing 787‑8 Dreamliner near Ahmedabad on Ju...

Indian households are increasingly moving away from traditional bank fixed deposits (FDs) in favo...

In a decisive move to reshape rural credit delivery in India, the National Bank for Agriculture a...

As the Reserve Bank of India (RBI) signals a potential shift in its monetary stance, the prospect...

India’s flagship digital payments platform, UPI, is undergoing a major upgrade that promise...

In a strategic move reinforcing its growth trajectory, UGRO Capital has ruled out any job cuts fo...

Bengaluru-based fintech Cred has secured ₹617 crore (~$72 million) in primary capital funding at ...

Mumbai‑based fintech‑NBFC FlexiLoans has raised ₹375 crore in the latest tranche of its Series C ...

Zaggle Prepaid Ocean Services is poised to generate an estimated ₹55–60 crore in incrementa...

India's market regulator, the Securities and Exchange Board of India (SEBI), has imposed a ₹3...

.webp)

RateGain Travel Technologies and Razorpay have joined forces to enhance hotel payment processing ...

India has witnessed a transformative shift towards a cashless economy over the past eleven years,...

The Reserve Bank of India (RBI) has raised concerns over continuing issues in the microfinance se...

Poonawalla Fincorp has unveiled a groundbreaking 24x7 digital loan service aimed at addressing th...

Facing intensified competition and tighter pricing regulations, India's leading online paymen...

Billionbrains Garage Ventures, the parent company of India's leading investment platform Grow...

India's government-owned nonbank financial institutions (NBFIs) are set to experience signifi...

IIFL Finance, a prominent non-banking financial company (NBFC), has secured regulatory approval f...

.jpg)

The Reserve Bank of India (RBI) has levied monetary penalties on Union Bank of India and Transact...

Getepay, a digital payments and merchant enablement platform headquartered in Jaipur, has receive...

In a pioneering move to bolster rural entrepreneurship, Gurugram-based non-banking financial comp...

The Reserve Bank of India (RBI) has set up a newly constituted Payments Regulatory Board (PRB) to...

The Reserve Bank of India (RBI) has imposed monetary penalties on 26 banks and financial entities...

In a significant move to enhance financial inclusion and ease customer access to banking services...

India’s non-banking financial companies (NBFCs) have the potential to double their growth t...

In a strategic move to bolster India's startup ecosystem, IndusInd Bank has signed a Memorand...

In a major consolidation move in India’s insurtech landscape, InsuranceDekho is set to merg...

Investment platform Groww has entered into a definitive agreement to acquire wealthtech startup F...

Non-Banking Financial Companies (NBFCs) in India are poised to increase their lending to Micro, S...

In a move underscoring growing scrutiny around lending practices, Canara Bank has announced a hal...

The fintech sector has experienced a significant wave of mergers and acquisitions (M&A) durin...

In 2025, the FinTech landscape is marked by both unprecedented opportunity and growing complexity...

As FinTech rapidly evolves, acquiring and retaining top-tier tech talent has become a defining ch...

In an age where digital transactions are the norm and customer trust is a currency, dat...

In the digital-first world of 2025, our identity is no longer just a piece of paper or plastic in...

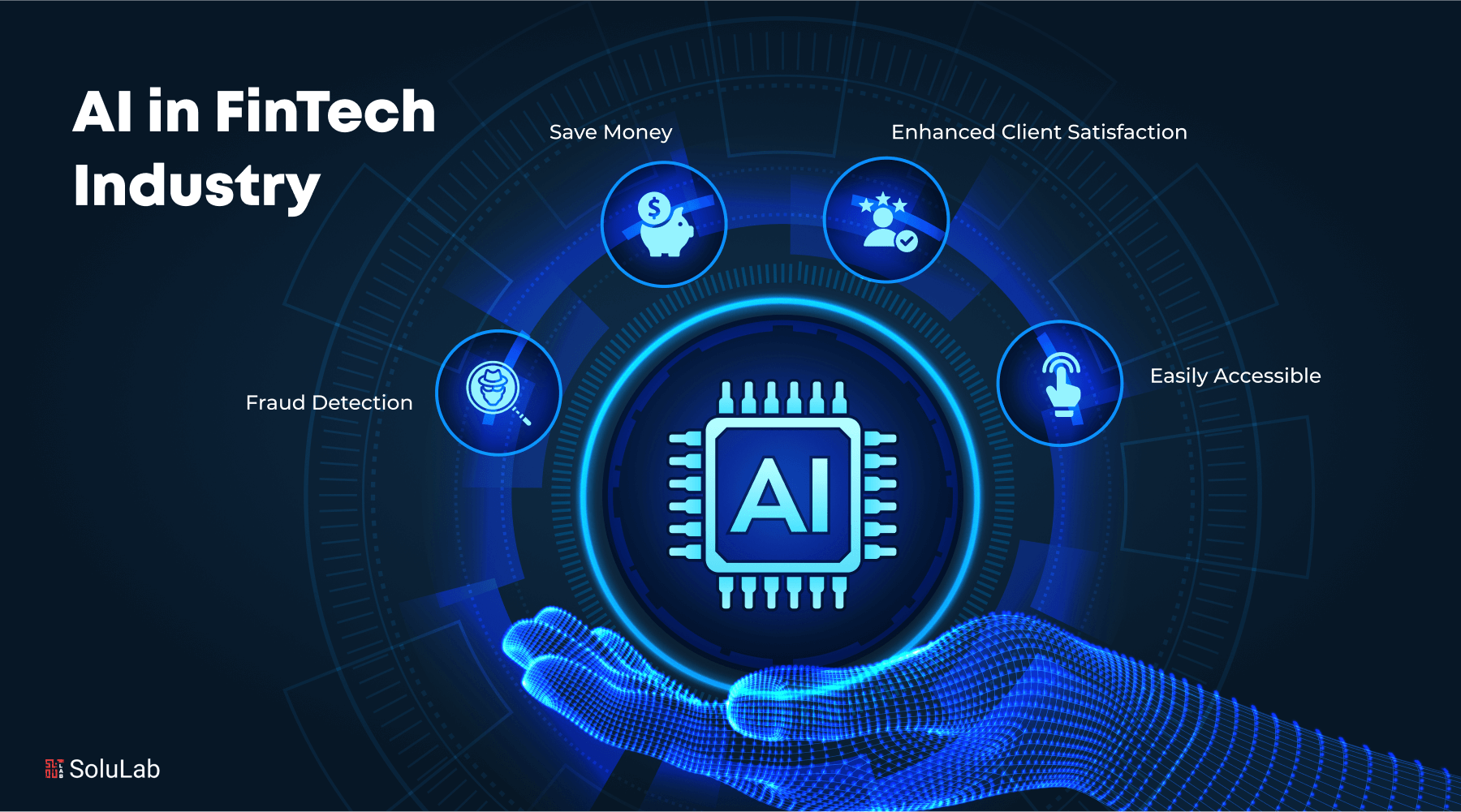

In 2025, the conversation around artificial intelligence (AI) in fintech has shifted from if it w...

The Reserve Bank of India (RBI) has proposed a significant update to the bank account nomination ...

Paytm Money demonstrated strong momentum in April by posting a 4% growth in active client numbers...

Muthoot Finance, one of India’s top gold loan providers, reported a robust fourth-quarter p...

Aditya Birla Capital Ltd (ABCL) is aiming for a sharp scale-up in its lending business, targeting...

Yes Bank is gaining renewed investor attention as a series of positive developments and broader m...

In a strategic move to attract more deposits and fuel credit growth, Canara Bank and Union Bank o...

🌍 Introduction: A Global Shift in Payments As globalization accelerates, the need for fast, t...

🌐 Introduction In today's fast-paced, digital-first world, the way we pay is evolving rap...

New Delhi, May 10 — Finance Minister Nirmala Sitharaman held a high-level review meeting wi...

New Delhi: Amid heightened tensions between India and Pakistan, the Indian banking sector has bee...

The Reserve Bank of India (RBI) has rolled out a fresh set of regulations aimed at tightening con...

.jpg)

The Reserve Bank of India’s (RBI) updated Liquidity Coverage Ratio (LCR) guidelines are poi...

The Digital Lenders Association of India (DLAI) has officially rebranded itself as the Unified Fi...

Shares of PB Fintech surged into focus after its subsidiary PB Pay received regulatory approval f...

Shares of brokerage firm Angel One came under pressure after the company reported a sharp 49% yea...

In response to a recent UPI outage, the National Payments Corporation of India (NPCI) has attribu...

Fintech unicorn Cred is reportedly in advanced talks to raise a fresh round of capital, even as i...

Just a few years ago, Buy Now, Pay Later (BNPL) emerged as a digital-age alternative to tradition...

The financial services industry is undergoing a rapid transformation—driven not just by dig...

Redefining Risk, Access, and Financial Inclusion Traditional credit scoring has long served as...

As the digital economy matures, consumers are demanding faster, safer, and more seamless ways to ...

India’s leading banks are responding swiftly to evolving monetary signals. HDFC Bank has tr...

.jpg)

In a strategic move to tighten fraud prevention mechanisms, Indian banks have collectively approa...

With the Reserve Bank of India maintaining a dovish stance in its recent monetary policy, several...

The Reserve Bank of India (RBI) has released a draft framework that could potentially alter the w...

In recent years, Open Banking has emerged as a disruptive force in the financial services industr...

Real-time payments (RTPs) are transforming how financial transactions are executed, offering busi...

In 2025, embedded finance is no longer just a buzzword — it’s the backbone of modern ...

UK-based fintech giant Wise has announced a major expansion of its India operations with the laun...

In a landmark development, fintech unicorn Pine Labs has received the final approval from the Nat...

In the last few years, QR (Quick Response) code payments have gone from a niche digital option to...

The Reserve Bank of India has granted final authorization to Resilient Payments Private Limited, ...

In today’s regulated and rapidly evolving FinTech landscape, building successful products i...

In the fast-paced world of FinTech, onboarding is no longer just a formality—it’s the...

.jpg)

As India’s financial ecosystem accelerates toward digital maturity, the convergence of inno...

In an increasingly interconnected financial landscape, APIs (Application Programming Interfaces) ...

A rift is growing in India’s digital payments ecosystem as several major payment gateways m...

At the recent Startup Mahakumbh 2025, India's G20 Sherpa, Amitabh Kant, underscored the neces...

In a world where consumers are constantly bombarded with generic offers and one-size-fits-all ser...

The financial services industry has entered a transformative phase in its digital journey—t...

Federal Bank has launched Fed StarBiz, a credit card tailored for small and medium-sized enterpri...

Finhaat, a financial product delivery platform, has announced the launch of Finhaat Wealth, a tec...

The Reserve Bank of India (RBI) has issued a letter of displeasure to Bajaj Finance concerning it...

India's banking sector is set for steady credit growth in FY26, with loan expansion projected...

Kotak Securities has identified six stocks poised for significant growth in April, with projected...

.jpg)

Payments have evolved far beyond simple transactions; they are now an integral part of daily inte...

As the fintech industry continues to evolve, the race to establish a Self-Regulatory Organization...

Zaggle Prepaid Ocean Services Ltd, a leading fintech SaaS company, has announced the acquisition ...

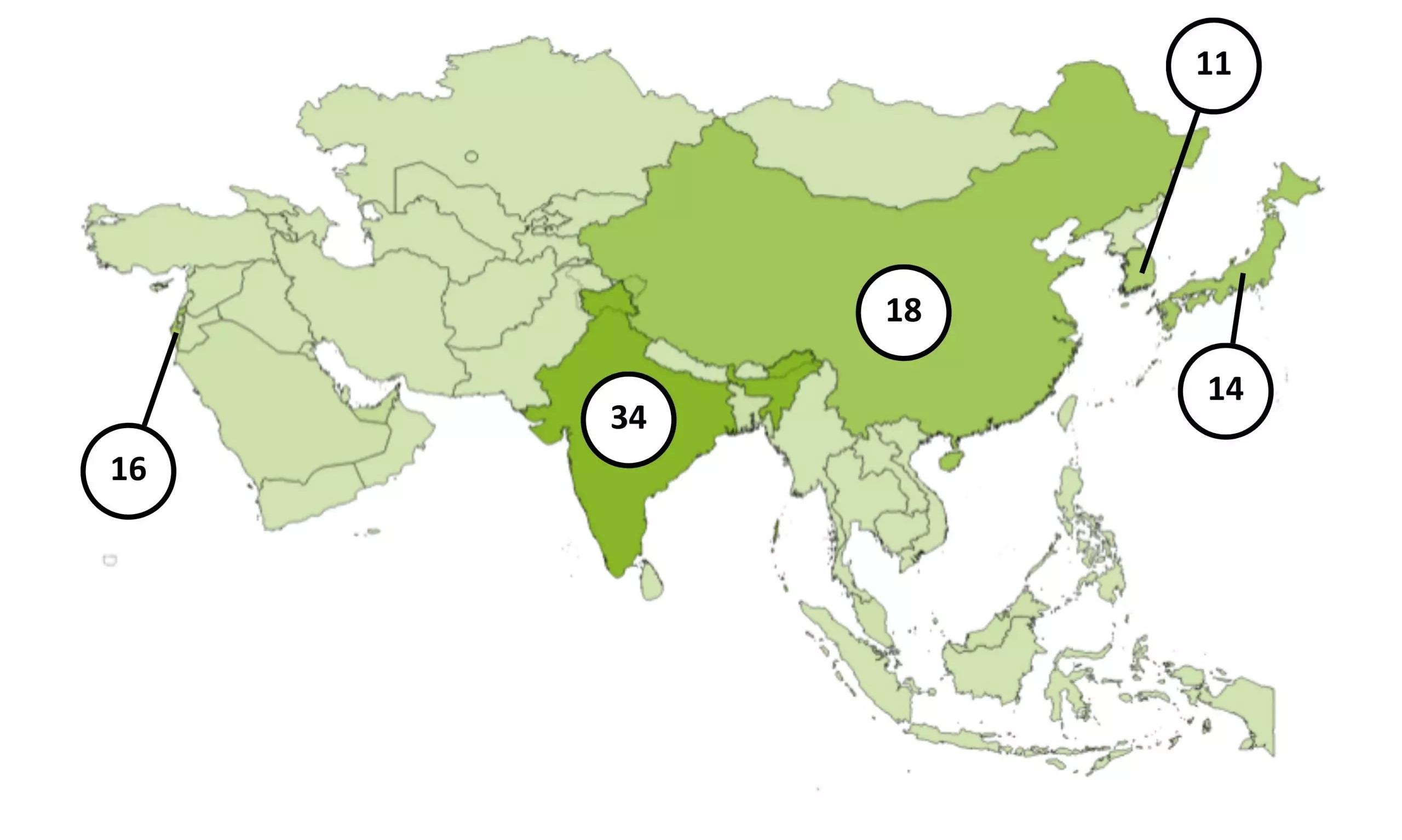

India has emerged as the dominant force in the Asian RegTech market, accounting for 21% of all de...

Smallcase, India’s leading wealthtech platform, has raised $50 million in its Series D fund...

Mumbai, India – PayU, the payments and fintech arm of Dutch e-commerce giant Prosus, has ac...

The intersection of technology and finance has become a powerful force in promoting financial inc...

The tech will enable users to converse with an AI system to initiate and complete transactions. ...

Introduction: The rapidly growing nature of fintech innovations often leaves regulatory framewor...

As we step into 2025, the fintech landscape is brimming with energy and opportunity. The past 12 ...

The world of finance has undergone a remarkable transformation in recent years, and at the heart ...

The world of finance has undergone a remarkable transformation in recent years, and at the heart ...

Fintech has dramatically reshaped the global financial landscape, offering innovative solutions t...

In 2025, open banking is no longer an emerging trend—it is a transformative force redefinin...

The digital banking revolution has transformed the financial services landscape, offering consume...

The world of finance has been undergoing significant transformations over the past decade, driven...

The financial technology (fintech) sector has seen extraordinary growth over the past decade, tra...