FinTech vs. Global Privacy Laws: Are You Ready for What’s Coming?

2nd August 2025

How AI is Transforming the Credit Scoring System

How AI is Transforming the Credit Scoring System

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

.jpg) The Future of Payments: Trends Reshaping Transactions in 2025

The Future of Payments: Trends Reshaping Transactions in 2025

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Biometric Payments: The Next Big Trend in Secure Transactions

Biometric Payments: The Next Big Trend in Secure Transactions

The Rise of Contactless Payments: Benefits and Security Concerns

The Rise of Contactless Payments: Benefits and Security Concerns

The Evolution of Fintech Regulation: What’s Next?

The Evolution of Fintech Regulation: What’s Next?

The Role of Cryptocurrencies in Cross-Border Payments

The Role of Cryptocurrencies in Cross-Border Payments

QR Codes and the Cashless Leap: Transforming India's Financial DNA

QR Codes and the Cashless Leap: Transforming India's Financial DNA

How Open Banking is Shaping Financial Services Globally

How Open Banking is Shaping Financial Services Globally

Top Fintech Innovations Shaping 2025: The Future of Finance

Top Fintech Innovations Shaping 2025: The Future of Finance

The Impact of 5G on Fintech Services

The Impact of 5G on Fintech Services

28 March 2025

1 min read

59

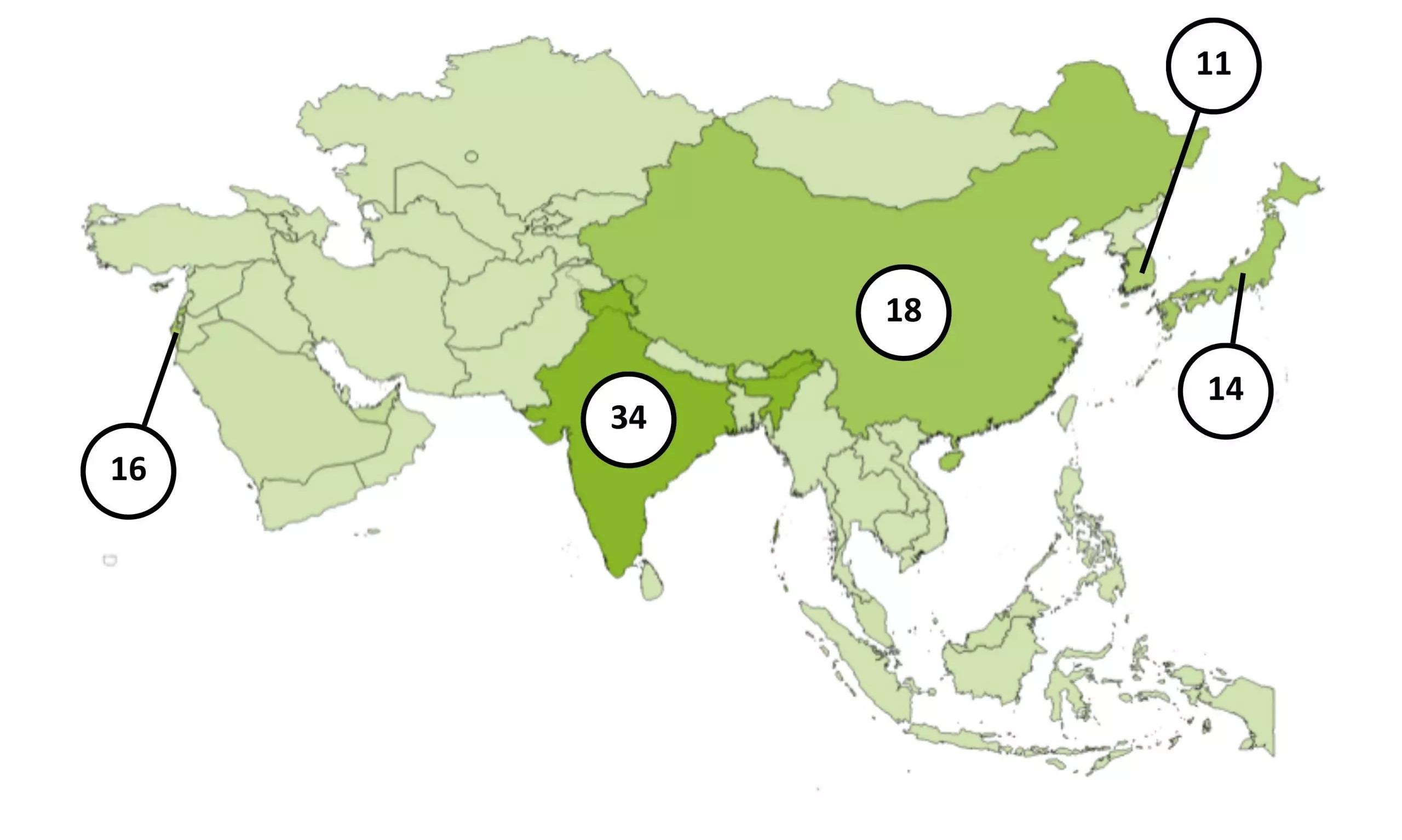

India has emerged as the dominant force in the Asian RegTech market, accounting for 21% of all deals in 2024, according to a report by FinTech Global. This milestone highlights the country’s rapid adoption of regulatory technology solutions to enhance compliance, risk management, and financial security.

As India’s financial sector continues to embrace digital transformation, investments in RegTech are rising, driven by increased regulatory requirements, digital banking expansion, and the growing need for AI-driven compliance solutions. Startups and established players alike are leveraging automation, AI, and blockchain to streamline processes and reduce fraud risks.

This surge in RegTech adoption positions India as a key player in shaping the future of financial regulation across Asia. Industry experts predict that India’s share in the RegTech market will continue to grow, fueled by strong government initiatives, fintech partnerships, and global investor confidence.

🔗 Read the full report here: FinTech Global

Read Next

News

News

Blog

Blog

Blog

Blog

News

News

News

News

News

News

Live Polls

Live Discussion

Topic Suggestion

Whom Do You Wish To Hear

Sector Updates

Leave your opinion / comment here