Global Expansion Strategies for FinTechs in Emerging Markets: A Playbook for Leaders

2nd August 2025

Biometric Payments: The Next Big Trend in Secure Transactions

Biometric Payments: The Next Big Trend in Secure Transactions

The Role of Cryptocurrencies in Cross-Border Payments

The Role of Cryptocurrencies in Cross-Border Payments

.jpg) The Future of Payments: Trends Reshaping Transactions in 2025

The Future of Payments: Trends Reshaping Transactions in 2025

Top Fintech Innovations Shaping 2025: The Future of Finance

Top Fintech Innovations Shaping 2025: The Future of Finance

The Rise of Contactless Payments: Benefits and Security Concerns

The Rise of Contactless Payments: Benefits and Security Concerns

The Evolution of Fintech Regulation: What’s Next?

The Evolution of Fintech Regulation: What’s Next?

How Open Banking is Shaping Financial Services Globally

How Open Banking is Shaping Financial Services Globally

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

What the Future Holds for Digital-Only Banks: Navigating the Next Era of Banking

How AI is Transforming the Credit Scoring System

How AI is Transforming the Credit Scoring System

The Impact of 5G on Fintech Services

The Impact of 5G on Fintech Services

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

Flipkart Gets a Lending Licence: A Bold Leap into Embedded Finance

QR Codes and the Cashless Leap: Transforming India's Financial DNA

QR Codes and the Cashless Leap: Transforming India's Financial DNA

19 May 2025

2 min read

111

Non-Banking Financial Companies (NBFCs) in India are poised to increase their lending to Micro, Small, and Medium Enterprises (MSMEs) by 20% in the fiscal year 2025-26, outpacing traditional banks despite facing challenges related to profitability.

Dominance in Micro-LAP Segment

NBFCs are expected to maintain a stronghold in the micro-Loan Against Property (micro-LAP) segment, particularly for loans under ₹10 lakh, where they currently hold a 45% market share. This is significantly higher than the shares held by private and public sector banks in this segment.

Challenges Ahead

Despite the anticipated growth, NBFCs are likely to encounter increased credit costs in FY25, primarily due to stress spillover from the microfinance and unsecured loan segments into the micro-LAP portfolio. Delinquency levels (PAR90+) remain higher in micro-LAP compared to larger loans, although both have shown improvement over the past two years.

Profitability is expected to moderate slightly due to narrowing net interest margins and higher credit provisioning. However, operating leverage may help offset some of these pressures.

Growth Drivers

Several factors are expected to support NBFCs' growth in MSME lending

Branch Expansion and Digital Transformation: NBFCs are expanding their branch networks and investing in digital technologies to enhance outreach and efficiency.

Co-Lending Arrangements: Collaborations with banks through co-lending models are enabling NBFCs to leverage lower cost funds while extending their reach.

Government Initiatives: Policies focused on employment generation and financial inclusion are facilitating improved access to formal credit for MSMEs, particularly for New-to-Credit borrowers.

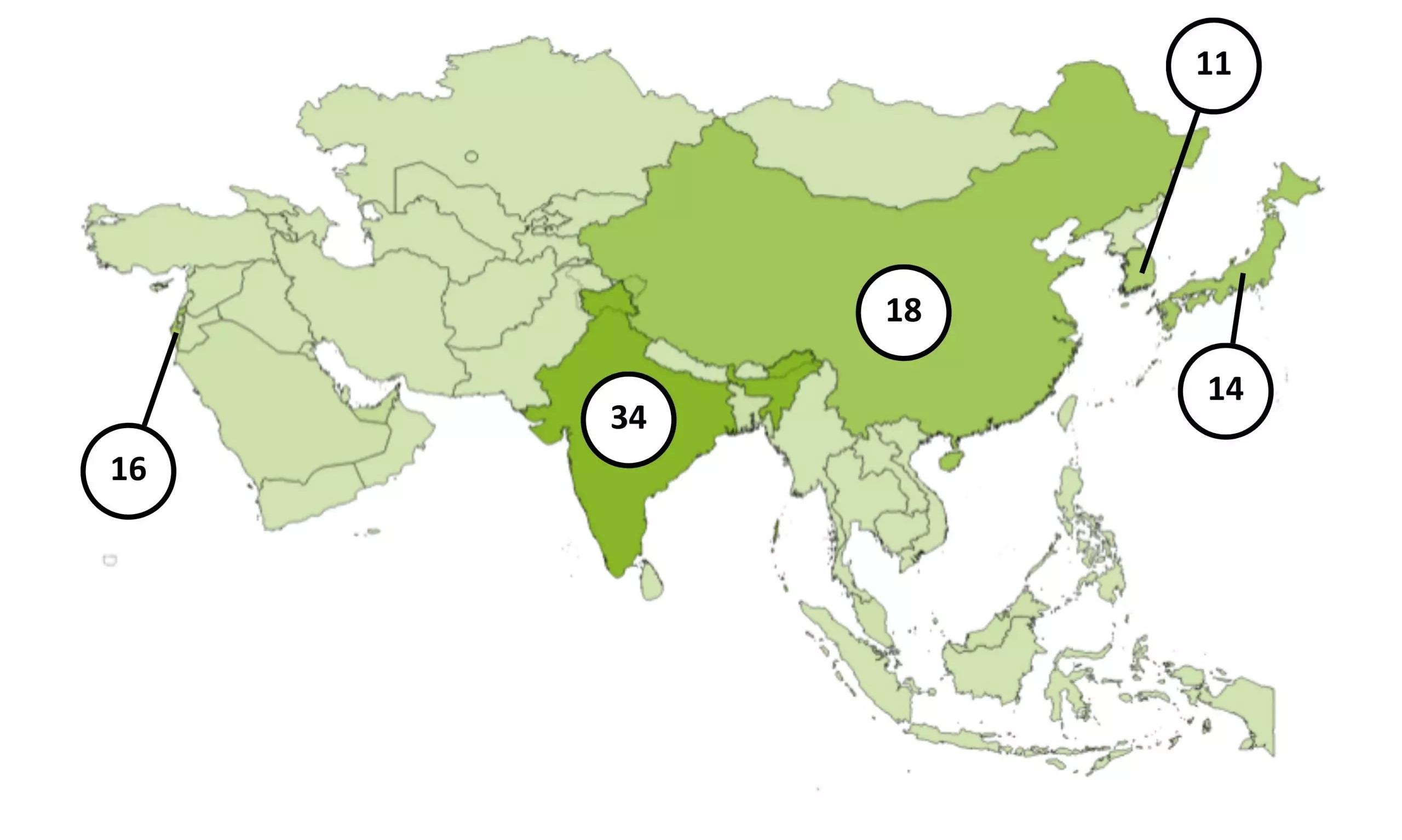

Between FY21 and FY24, NBFCs recorded a 32% Compound Annual Growth Rate (CAGR) in MSME lending, surpassing the 20.9% CAGR by private banks and 10.4% by public sector banks. Consequently, NBFCs’ share of MSME loans in their total portfolio rose from 5.9% in FY21 to 9.1% by the first half of FY25.

While private sector banks are gaining ground in the LAP segment above ₹10 lakh, now leading with a 42% market share compared to NBFCs’ 37%, NBFCs' dominance in the micro-LAP segment remains unmatched.

As the MSME sector continues to be a vital component of India's economy, NBFCs' proactive strategies and adaptability position them to play a crucial role in meeting the credit needs of this segment, despite the profitability challenges ahead.

Reference: ET BFSI

Read Next

News

News

News

News

News

News

News

News

Article

Article

News

News

Live Polls

Live Discussion

Topic Suggestion

Whom Do You Wish To Hear

Sector Updates

Leave your opinion / comment here